English High School History

Albert Henry Wiggin, English High Class of 1885, Known by Some as the “Wall Street Savior”

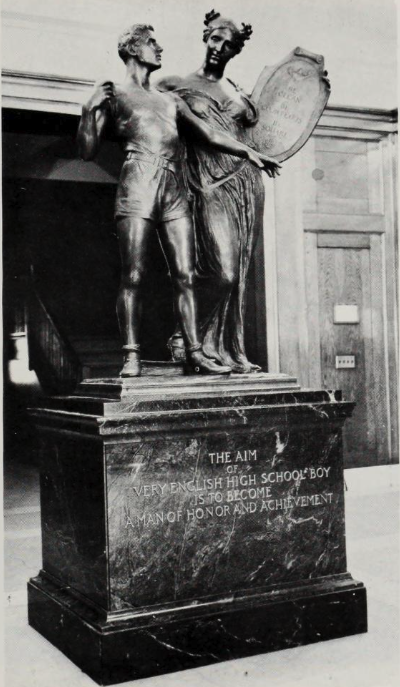

“The Spirit of English High School” by Daniel Chester French, 1927 shown in the corridor of the school’s Warren Avenue location circa 1930.

Thousands of English High students have gazed on the bronze “Spirit of English High” sculpture in the hallway of its different locations. The piece was created by nationally known architect Daniel Chester French. It was officially unveiled in 1928. It has stood the test of the time for nearly 100 years. The statue was commissioned and paid for by English High graduate Albert Henry Wiggin for $25,000 in 1928. That would be nearly half a million in today’s dollars.

When people think of English High grads who became titans of business and industry, J.P. Morgan and Charles Hayden come to mind immediately. But the quiet and unassuming Mr. Wiggin became an international banking legend.

Albert Henry Wiggin, English High School Class of 1885

Albert Wiggin was born on February 21, 1868, in Medfield, Massachusetts. His father, James Henry Wiggin, was a Unitarian minister..

Wiggin graduated from English High School in 1885 but did not go to college. Instead, he pursued low-level jobs in Boston’s banking sector, first as a runner — in the days before the proliferation of telephones, young men would race about town hand-delivering messages — and later as a bookkeeper. By the age of 23, he secured a job as an assistant for a national bank examiner, and two years later he became the assistant cashier of the Third National Bank of Boston.

Within the banking world, Wiggin gained a reputation as a banking “Wunderkind” for being a diligent, serious and deeply-focused worker. In June 1899, he was invited to New York City to become vice president of National Park Bank. Wiggin’s talents piqued the interest of Alonzo Barton Hepburn, CEO of Chase National Bank, and in 1904 he invited Wiggin to become a vice president. At 36, Wiggin was the youngest vice president in the bank’s history — and 11 years later, he succeeded Henry W. Cannon as the bank’s president.

Under his leadership, Chase underwent an unprecedented growth epoch — deposits swelled from $91 million in 1910 to more than $2 billion in 1930, a number of smaller competitors were acquired, a lucrative securities division was launched, and the wealthy Rockefeller clan were lured into becoming investors. Wiggin was elevated to CEO and chairman of the board in 1917. Chase was now the fourth largest bank in America.

Albert Wiggin, left, with fellow English High alumni J.P. Morgan together in 1917 at a War Bonds parade in New York City.

Wiggin became an important player on the world financial stage and in 1923 opened a Chase National Bank representative office in London which began lending directly to governments and businesses throughout Europe. Wiggin also developed other foreign banking corporations in places such as Paris, Rome, Panama City and Berlin. Wiggin was a staunch proponent of Free Trade albeit under certain restrictions. He was a signatory to the 1926 international round robin declaration by over 100 of the world’s most powerful financiers that called upon European nations to remove their tariff barriers to international trade.

Riding to Wall Street’s Rescue

On October 24, 1929, the Dow Jones Industrial Average opened at 305.85 and promptly crashed by 11% amid intra-day trading levels that were three times the average amount of activity. Apprehension in the state of the national and global economies had been growing for weeks prior to this happening, and the record-breaking crash signaled a cacophonous finale to the Roaring Twenties.

However, Wiggin was not eager to see the stock market drag the nation into ruin. He quickly coordinated a meeting with two of his most prominent peers, Thomas W. Lamont of Morgan Bank and Charles E. Mitchell of the National City Bank of New York. The three bank executives called on Richard Whitney, vice president of the New York Stock Exchange, to put through a bold move designed to address the panic.

Whitney went to the Exchange floor and enacted a highly dramatic bid to buy 25,000 shares of U.S. Steel at $205 per share. The three bankers were financing Whitney’s action, and traders were astonished that Whitney was making a purchase at a price that was much higher than the current market, which began to pump enthusiasm and energy back into the Exchange. Word quickly spread that Wiggin was the off-stage driving force for this action, which helped to halt the free-fall taking place. By day’s end, the Dow was only down by 6.38 points.

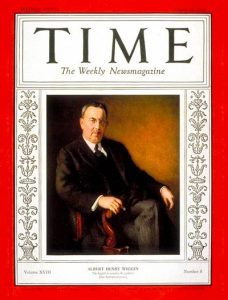

On Aug. 24, 1931 Wiggan made it to the cover of Time Magazine.

Unfortunately, a variety of perfect storm circumstances ultimately overwhelmed Wall Street, fueling the Great Depression. But Wiggin’s act of financial heroism was viewed by many as a crowning achievement in a glorious career.

However, on a questionable end note, starting in September 1929, Wiggin commenced selling short his personal shares in Chase National Bank.

It wasn’t until a 1932 U.S. Senate investigation into the causes of the 1929 crash that Wiggin’s transactions became public knowledge.

And while it was shown he was not the only banking executive who committed such an action, he received an unwanted form of immortality when the 1934 Securities Exchange Act included the “Wiggin Provision” that prohibited company directors from selling short on their own stocks in order to profit when their company faced wreckage and ruin.

Since the Wiggin Provision could not be applied retroactively, Wiggin never faced prosecution. He retired from banking in 1932 and devoted his remaining years to philanthropy, supporting educational and nonprofit organizations and donating his considerable art collection to the public libraries in New York and Boston and the Baltimore Museum of Art.

Following his death in 1951, the New York Times recalled Wiggin’s finest moments by praising him as “one of the banking leaders who made large sums available to bolster the slipping market. The confidence that he and other leading bankers showed in the country was credited with having done much to prevent the complete collapse of the nation’s financial structure.”

(Compiled from multiple sources)