Alumni Profile

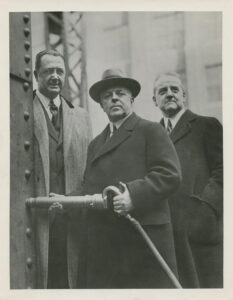

Charles Hayden, EHS Class of 1886, A Towering Figure in Business and Philanthropy

The Charles Hayden Foundation continues giving millions in grants to this day.

When people think of a very successful English High businessmen, they naturally think of JP Morgan. But another towering figure in American business was Charles Hayden, (1870-1937) EHS Class of 1886.

Hayden was a banker, businessman and philanthropist. He co-founded the brokerage firm of Hayden, Stone & Company; helped establish the Hayden Planetarium in New York, the Charles Hayden Planetarium at Boston’s Museum of Science, and the Charles Hayden Foundation; and financed Arizona copper mines and smelters.

Hayden was born on July 8, 1870 in Boston. He was the elder of two sons. His father was a prosperous Boston leather and shoe merchant.

Education

Hayden’s father wished to send him to Harvard, after his EHS public school education, but at 15 Charles had already decided that his fortunes lay in copper, the metal essential to the burgeoning electrical industry, and he chose instead the Massachusetts Institute of Technology. There he emphasized mining and economics in his studies and graduated in 1890.

Career

After taking the usual (for the well-to-do) “grand tour” of Europe, Hayden returned to Boston, then the principal market for copper mine stocks, and entered the brokerage firm of Clark, Ward & Company.

Borrowing $20,000 from his father, and joining with 30-year-old Galen Stone–also associated with Clark, Ward & Company and an erstwhile financial editor of the Boston Advertiser–who also borrowed $20, 000, Hayden founded the brokerage firm of Hayden, Stone & Company in 1892. Though the new partners bought seats on the Boston Stock Exchange, times were hard and customers few. Hayden and Stone had to watch their funds carefully and once even hesitated about spending $25 dollars for a list of copper stockholders. The list proved to be the turning point in their fortunes; with great care Hayden and his partner produced a keen analysis of copper companies’ stocks, based upon the conditions of the industry and the current state of the market, and mailed it to each of the names on the list. Orders began to come in with greater regularity, and with the upturn in business conditions after 1896 Hayden, Stone & Company was on its way to prominence.

Only two or three Americans have equaled the number and variety of directorships that Charles Hayden held. During his lifetime he was appointed director to 89 companies, and held 58 directorships at the time of his death.

For a time the firm continued to specialize in copper stocks, but after 1906, when it moved to New York City, it expanded into many fields, particularly during and after World War I. As his personal investments and prestige grew, he was elected to many boards of directors. He was chairman of the Chicago, Rock Island & Pacific Railway, the Adams Express Company, International Nickel Company, Ward Baking Company, and the Hotel Waldorf-Astoria Corporation. After Stone’s death in 1926 Hayden fully dominated the company. He was active in his business until a few weeks before his death.

Charles Hayden helped establish the Charles Hayden Planetariums in Boston and in New York City.

Achievements

Charles Hayden is remembered as a prominent banker, businessman and philanthropist. Only two or three Americans have equaled the number and variety of directorships that he held. During his lifetime he was appointed director to 89 companies and held 58 at the time of his death including mining, transit, freight, banking, and manufacturing companies. Hayden played an important part in the development of the Utah, Chino, Ray, and Nevada Consolidated copper companies and their later merger into the Kennecott Copper Company. In 1936 his firm sold to the public $100, 000, 000 in bonds for the financing of the Brooklyn-Manhattan Transit lines. For all his accomplishments in finance, Hayden’s most outstanding claim to renown was his philanthropy. Just when he became interested in boys’ work is not apparent, but it is known that he contributed $100, 000 in 1926 to the Boys Club of New York.

Upon his death it was revealed that he had bequeathed the major portion of his estate, or about $50,000,000, ($900 million in today’s dollars) to establish the Hayden Foundation, for the purpose of financing the erection of Boys’ Club buildings, making grants to charities in New York and Boston and aiding youth-service organizations such as the Boy Scouts of America. He also gave generously to the Red Cross and to the Massachusetts Institute of Technology.

Personality

Hayden proved himself a brilliant judge of men, managements, and financial data. His ability to spot weaknesses or hidden values in financial matters became legendary during his lifetime.